IRIS is an online system that provides a user-friendly, accessible auditory interactive layer for sites of banking institutions. The inclusive system allows for a secure and private experience by incorporating web knowledge authentication, Face and Touch ID. IRIS takes advantage of emergent technologies like voice user interfaces and will ultimately incorporate the latest artificial intelligence software.

IRIS VISION

As a child growing up I’ve always questioned how my uncle Marcus perceives the world. He was born with a vision disability in the late fifties in San José, Costa Rica and with limited access to technology, medical, psychological and pedagogical advancements, his life hasn’t been the most lenient. Nonetheless, he’s one of the happiest individuals I’ve ever met.

This is my story of how User Experience Design can raise the technological bar for the promotion of independence and inclusivity for populations living with visual disabilities.

How can design and biology merge to improve the quality of life of its users and enhance human interactions by creating dignified experiences?

IRIS PROCESS

The framework of the IRIS system is constructed upon four main pillars, user experience, accessibility features, employment, and community engagement. Through the applicability of user experience design tools, IRIS reduces the friction between design and disability and incorporates accessible features that are embedded into its operational system.

PRE-STUDY

As part of a pre-study, diverse interviews were done with experts in the field. This phase of the study was done in collaboration with an organization called “Nueva Luz” which is based in San José, Costa Rica.

Additionally as part of the pre-study, and before the user testing was held, several interviews were carried with Cirsa Alvarado, the director of the User Experience Design team at BAC International Bank. Alvarado is responsible for UX strategies in Latin American.

Diverse questions were sent concerning the inclusivity initiatives and programs that the bank runs at a regional level. An analysis of the different digital channels was done and it was concluded that users with vision disabilities don’t have the same access to these platforms as sighted people. A chart was created to understand the different limitations in Digital and Non-Digital services based on the different types of disabilities.

USER DATA ANALYSIS

During the work, an analysis of interviews and user testing was held with users with visual disabilities. The primary objectives were to investigate the contextual auditory information regarding financial transactions, an exploration of the existing digital tools that are currently being used and the possibility of the implementation of voice user interfaces. The findings of the study concluded that multimodal interfaces expedite the process by combining voice, haptics, and quality visuals.

The process of the interviews started with a transcript that served as a starting point for the user data analysis. Later, the most relevant feedback was written down in post-it notes and different thematics were drawn in terms of similarity. The thematics were drawn by chronological order depending on the interviews that were carried.

THEMATICS

It was concluded that the following thematics were predominant in almost all the interviews:

- There is a difference between users with low vision and users who were born blind.

- CVUIs should be able to accommodate in the visual disability spectrum, giving the users complete independence and control over the different functionalities.

- Using CVUIs is not ideal in public spaces.

- Privacy is always a barrier when using online tools.

- Security measures that are currently being implemented are not user friendly or inclusive.

- Some online platforms don’t follow accessibility norms like the “Accessible Rich Internet Applications (ARIA)”

- Some security measures have a time constraint, which in some cases, is not compatible with screen readers.

- Online platforms are usually not user-friendly with screen readers. Users require turning them off, switching their phone settings, etc.

- The visual navigation of newer online platforms is initially hard to learn.

- Users learn to navigate from A-B and B-A.

- A linear navigation method would be the most ideal and inclusive

The goal of this qualitative study was to identify and understand the pain points of users with visual disabilities regarding their administration of personal finances. Moreover, empathize with how they’ve attempted to relieve their struggles with existing tools and gather insights about VUIs and haptics.

CONCEPT

FUNCTIONALITIES

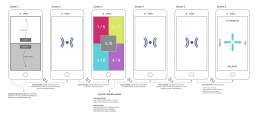

Through the analysis of data, conclusions were made per different concept functionalities. The future iteration of the concept can accommodate different types of visual disabilities, incorporating a multimodal function with a haptic system of voice, vibrations, sounds, and high-quality inclusive visuals.

Since some users indicated that they had low vision, feedback will also be included taking into consideration the use of visual interfaces. IRIS is designed inclusively for users with low vision following the “GOV.UK, Home Office Digital, Data and Technology (DDaT)” guidelines. Originally, the layout of the screens was designed with a high contrast mode, bold and readable text. The system also applies a combination of colors, shapes, and text and follows a linear logical layout. Buttons and notifications are put in context.

In the case of users with no vision at all, the system runs solely on voice, sounds, and vibrations. The users are provided with an integrated auditory feedback like the sound of a piano key indicating a successful transaction. If a user is stuck or needs to go back in the process the user is instructed to give a verbal command for the system to repeat itself or go back several steps.

CONCEPT STRATEGIES

IRIS is a cloud-based service that allows for the development and design teams to work on it on the fly with bug fixes, updates, and service expansions. The marketing structure of the service is shared with more than one financial institution making a split development cost.

The system is designed to be marketed with a Year One Exclusivity by giving the first banks that acquire the service exclusive pricing. The license of the system is sold as a Monthly Subscription, including service & maintenance costs, making IRIS innovative and inclusive by raising the bar of user experiences in the banking fields.

USER JOURNEY

IRIS service is mapped out in a user journey to demonstrate the vision of the project by communicating the possible concept stakeholders, user pains, needs or possible outputs. The user journey also served the purpose of identifying functionality levels, dependent on the level of visual disability. This User Experience tool helped define user flows and the overall information architecture.

FUTURE

The proposed concept would be satisfying to be executed in the future since it would eventually become a very necessary technological solution for populations with visual disabilities, and a design breakthrough that would make me feel personally accomplished.

IRIS will create autonomy, independence, and inclusivity for a population that has been excluded from dignified digital experiences. Having the empathy to understand the struggles that people with disabilities face day-to-day ignited the need to design for those in vulnerable conditions. I felt driven to use my design skills and talent to create a platform that facilitates the banking experience for so many users. IRIS will change and enhance the quality of life with its vision of User Experience Design.

IGNACIO BARBOZA

Ignacio Barboza is a UX / UI designer currently based in San José, Costa Rica. He designs for private and commercial projects within the digital realm and incorporates interdisciplinary practices.

With an educational background in London, England, and Vancouver, Canada, Ignacio designs UX solutions that often improve the quality of life of its users.

Producing empathetic experiences, Ignacio’s work situates in a unique space by having a personal engagement with inclusive design, design for disability and health design. On-brand, deeply rooted in hot Latino flare.